Are you planning to sell your current home and buy a new one in the same state? If yes, it’s important to consider your “tax portability” options. Tax portability is a unique benefit provided by the State of Florida that can help you save a considerable amount of money on your property taxes.

What is Tax Portability?

Portability, AKA “Transfer of Homestead Assessment Difference”, is the ability to transfer the dollar benefit of the Homestead CAP from one Homestead to another. Simply put, tax portability allows residents that are moving from one primary residence to another to bring the built-up property tax benefits on the assessed value of their existing home with them to their new home. This can mean up to a $500,000 decrease in the taxable value of your new home and a HUGE annual property tax savings!

Interesting! How does Tax Portability work?

Here’s how it works: Florida primary residences are protected to a maximum percent increase in the assessed value each year by homestead legislation known as “Save Our Homes”. Without the portability provision, if you moved, you lost ALL of the assessed value savings created by Save Our Homes, and your new home would be assessed at the current market value.

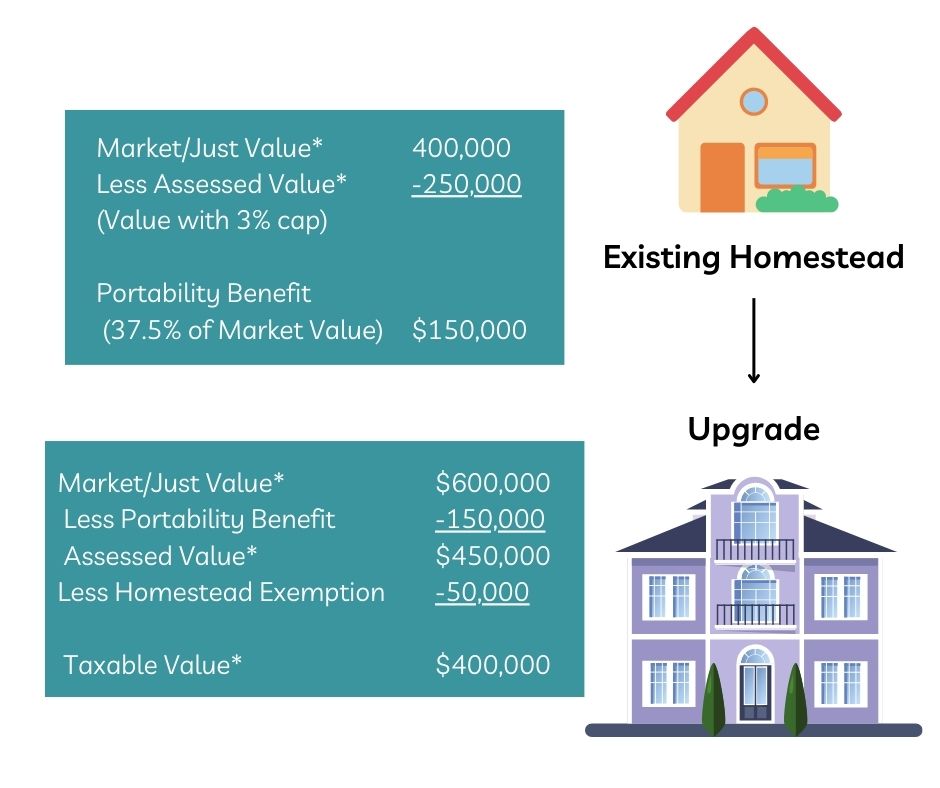

In practice, this is what they calculation looks like:

In the example above, the homeowners were able to “port” $150,000 of their current homesteaded assessed value savings to their new home. So instead of paying property taxes on the $550,000 ($600,000 – $50,000 of the Homestead Exemption Savings) assessed value of their new home, they only have to pay property taxes on $400,000 ($550,000 – portability benefit of $150,000).

Who can take advantage of this benefit?

This unique benefit is available only to those who have a Homestead Exemption in the state of Florida.

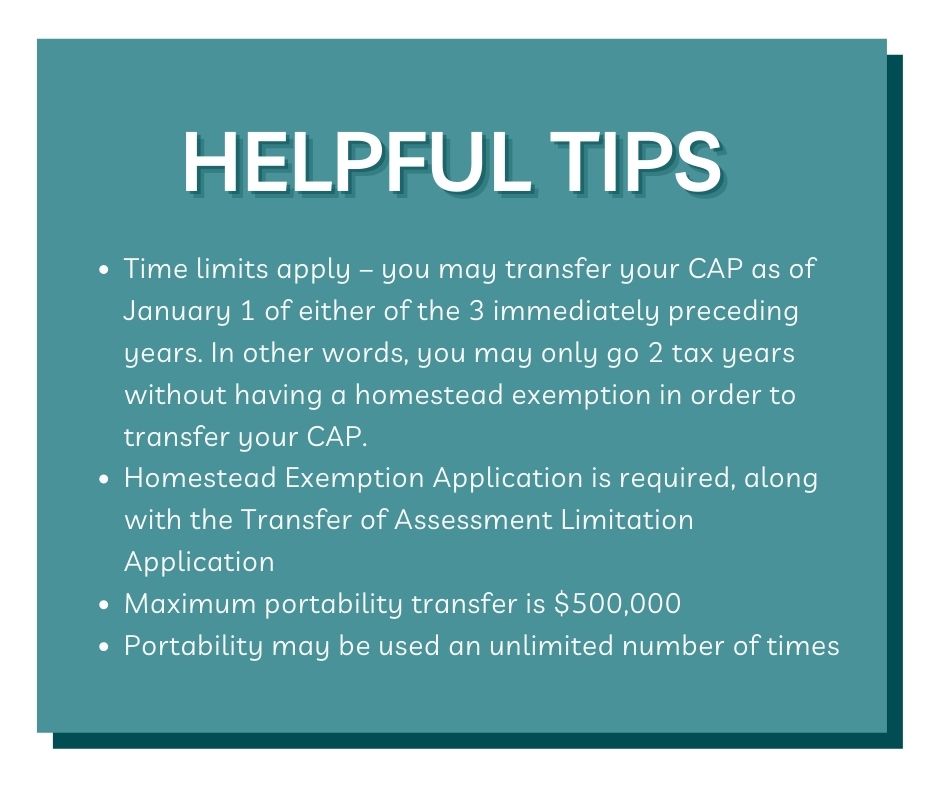

Take a look at the helpful tips below:

How do I apply for Tax Portability?

As a Floridian, knowing about this benefit is essential to ensure you take advantage of every opportunity to save money. You can find more information and the required application links at your local county property appraisal websites. We’ve linked several below for your convenience.

Hillsborough County – https://www.hcpafl.org/property-info/homestead-other-info

Pinellas County – https://www.pcpao.gov/homestead-exemption

Pasco County – https://pascopa.com/exemptions/exemptions/homestead/

Sarasota County – https://www.sc-pa.com/exemptions/homestead/overview/

Manatee County –https://www.manateepao.gov/definitions/additional-homestead-exemption/

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link