Agent Spotlight: Manuela Redaelli

Manuela Redaelli was born and raised in Italy. There she received a college degree in architecture, a master’s degree in Environmental Management Systems, and a post-university course in community local action and sustainable urban development. Manuela is also a certified Fitwel Ambassador as a healthy building strategist and a member of the National Association of Environmental Professionals.

Manuela is an architect entrepreneur and sustainability strategist for healthy buildings, healthy communities, and healthy corporations. For 20+ years, she worked exclusively in the architectural field, from micro to macro scale – from interior design to urban master planning and residential to commercial areas. She also won awards in international architectural competitions.

After moving to the US six years ago, Manuela started to apply the sustainable approach in other fields besides architecture. She launched the new conscious concept GEMYS (Get Experience, Master Your System), working to create a connection between architecture, food, and wellness for a better living for residential and commercial complexes. The GEMYS food concept earned the 2019 Miami Beach Award Program nod for exceptional marketing success in their local community and business category.

“Since I’m an architect, I’m used to understanding people’s dreams and needs,” Manuela said. “And I’m very familiar with the product we are helping people sell or buy – houses, buildings, and complexes. I’m also very familiar with the construction process and its economic impact on the environment.”

Manuela is deeply passionate about providing high-quality service with empathy. She describes herself as very enthusiastic, detail-oriented, and striving to have new experiences. Why did Manuela choose a career in real estate? “The real estate sector is the engine of the economy,” she said. One of Manuela’s favorite parts of her job is following people and businesses throughout the lifecycle of a real estate transaction. She defines her value proposition as a cross-disciplinary knowledge approach with a big vision to reach a sustainable transaction and long-term satisfaction for all parties involved.

In 2016, Manuela started visiting Tampa Bay for leisure. She moved here definitively from Miami Beach in October 2022 for the incredible combination between urban lifestyle and vacation opportunities. Manuela and her husband of over 20 years are dog lovers with multiple wire hair dachshunds. She enjoys the outdoors, traveling, and supporting communities through various associations in her free time. She is a member of the Rotary Club of Tampa and a fellow of the “Save the Soil” movement.

Contact Manuela Redaelli to learn more about buying, selling, or investing in a property.

5 Reasons an Insurance Company Might Cancel Your Policy

Storm risk is just one of many reasons insurance policies are canceled. For starters, insurance companies cancel policies because of late payments, pets, old roofs, and trees in the wrong place.

Worried that your homeowner’s insurance could be canceled one day? Well, you won’t be able to blame it on the hurricanes in 2022.

Why Insurance Companies Cancel Policies

There are many reasons why your insurance company might cancel your policy, such as not paying your premiums, the risk of wildfires in your area, not taking care of your home, or making too many claims. But there are also some unusual reasons, like certain dog breeds, snakes, electric vehicle hookups, and solar panels.

While an insurance company can’t typically cancel a single policy because of more storm damage, it could end up writing policies in a high-risk area like Miami-Dade County. Or it could stop writing policies altogether, as many have seen in Florida over the past year.

1. Water, Water Everywhere

Water damage is the most common type of loss, not just in Florida but everywhere. Anything to stop water damage then is critical. Steel braided hoses should be used for anything that has to do with water, like the fridge or the toilet. Insurance companies don’t want to see rubber hoses or water heaters that lack an overflow tank. Water heaters usually last about 10 years.

A high-tech water leak system can shut off the water when it detects unusual water patterns. This would reduce the chance of water leak damage. The device connects to the water supply mainline and links to a phone app. This technology can quickly tell you why water is running in a given area of your home at any given time. An alert for unusual water usage may be sent, and if there’s no response, the water will be turned off. This system can also find a leak in the toilet. This kind of technology is mainly meant to help you avoid having a loss in the first place, and you may get a discount on your policy.

2. In The Dog House

Your pets are just one of the strange things that can cause your policy to be canceled. If your dog hurts someone or causes damage to their property, your liability coverage on your home insurance policy should cover it. That is, unless your dog is a “restricted dog breed,” like a pit bull, Rottweiler, or Doberman, which has been banned in Miami-Dade County for over 30 years.

Breeds on the restricted lists vary by company and state. The Akita, the American pit bull terrier and pit bull, the Chow Chow, the German Shepherd, the Great Dane, the Rottweiler, the Siberian Husky, and the Wolf hybrid are all standard breeds that are likely to cause an insurance rate increase or cancellation. Several insurance companies do not have rules about what kind of dog you can have. You can do a simple DNA test if you’re unsure what breed your dog is. The amount of each breed could also be a factor.

3. Exotic Pet Problems

Many insurance companies won’t cover snakes like boa constrictors, venomous snakes (which are illegal in Florida), or even ferrets because they see them as a risk. Some insurance companies don’t cover people who own reptiles because they think it’s too risky.

Tell your insurance company if you have an exotic pet or a dangerous dog. Even if someone gets bitten once, your policy might not be canceled. However, if you never told the insurance company that you owned the dog, you would be responsible for all medical bills.

4. The Sun Is Setting on Solar Panels

A recent story from First Coast News in northern Florida said that some insurance companies are dropping Florida residents who want to put solar panels on their homes, and some are just dropping customers who already have solar panels.

According to that report, an insurance agent in St. Augustine said it might happen because of a clause in some contracts with Florida Power and Light that says, “you as a homeowner are responsible for paying for all of the damage caused by the panels.” One example is if a power surge from the panels hurts the grid or other homes.

The report also stated that home insurance companies deny coverage if the homeowner wants to sell the extra power their solar panels make back to the electric company. Net metering is the system’s name, and it is a common way for a homeowner with solar panels to use it.

5. Electric Cars Could Be Off The Grid

An article in The Balance stated that putting a charging station for your car in your garage or driveway could affect your home insurance. Some state laws require homeowners to have liability coverage for the charging equipment. The report said that some underwriters might want to see photos or documents showing the unit was installed correctly.

Before adding a charging station to your home, discuss any requirements with your home insurance agent. It would be best if you also got more comprehensive car insurance. Most of the time, hard-wired charging stations are considered part of your home. Depending on the type and cause of loss, the station will likely be covered. If the charger catches fire because of a problem with the home’s wiring, the homeowner’s insurance will likely cover the fire.

Pineapple Insurance is Here to Help

When you’re unsure about what’s covered by homeowners insurance, Pineapple Insurance is happy to answer any questions about what a policy covers. Contact us at 813-438-7240 or visit us at pineappleinsure.com, and we can review existing coverages for your home, flood, auto, or umbrella policies.

Agent Spotlight: Harnish Nayyar

With a background in property investing and human resources, Harnish Nayyar boasts a deep understanding of real estate transactions with global experience. Born and raised in New Delhi, India, Harnish earned her undergraduate degree from Delhi University and an MBA from Amity School of Business Delhi.

Harnish then spent several years working as an assistant HR manager for an international Indian airline. Managing conflict resolution as well as hiring and retaining employees in this role, Harnish developed excellent communication and negotiation skills.

“I am great in cross-culture management,” she said. “I come up with creative solutions to problems or issues. I am self-motivated, and a professional reputation is very important to me.”

Harnish has lived in Tampa for over a decade, relocating from Minnesota to the sun-drenched coastal living in Florida. Here, she and her husband invested in real estate properties, leading her to get her real estate license. And Harnish is passionate about helping others through the process of buying or selling a home.

“Every real estate transaction has some kind of unique attributes attached to it,” she said. “Some are investor specials, and some are a great fit for homebuyers.”

When Harnish is not busy selling homes, you can find her very involved in the community. Along with her husband, the Vice President of Sales for one of the world’s largest natural stone producers, and her 9th-grade daughter and 4th-grade son, she loves volunteering at Feeding Tampa Bay and Hope Children’s Home on the weekends. Harnish is also part of the Indian Punjabi Association of Tampa and plays tennis, practices yoga, and exercises on a daily basis.

If you’re on the hunt for your next investment or dream home, contact Harnish today to learn more!

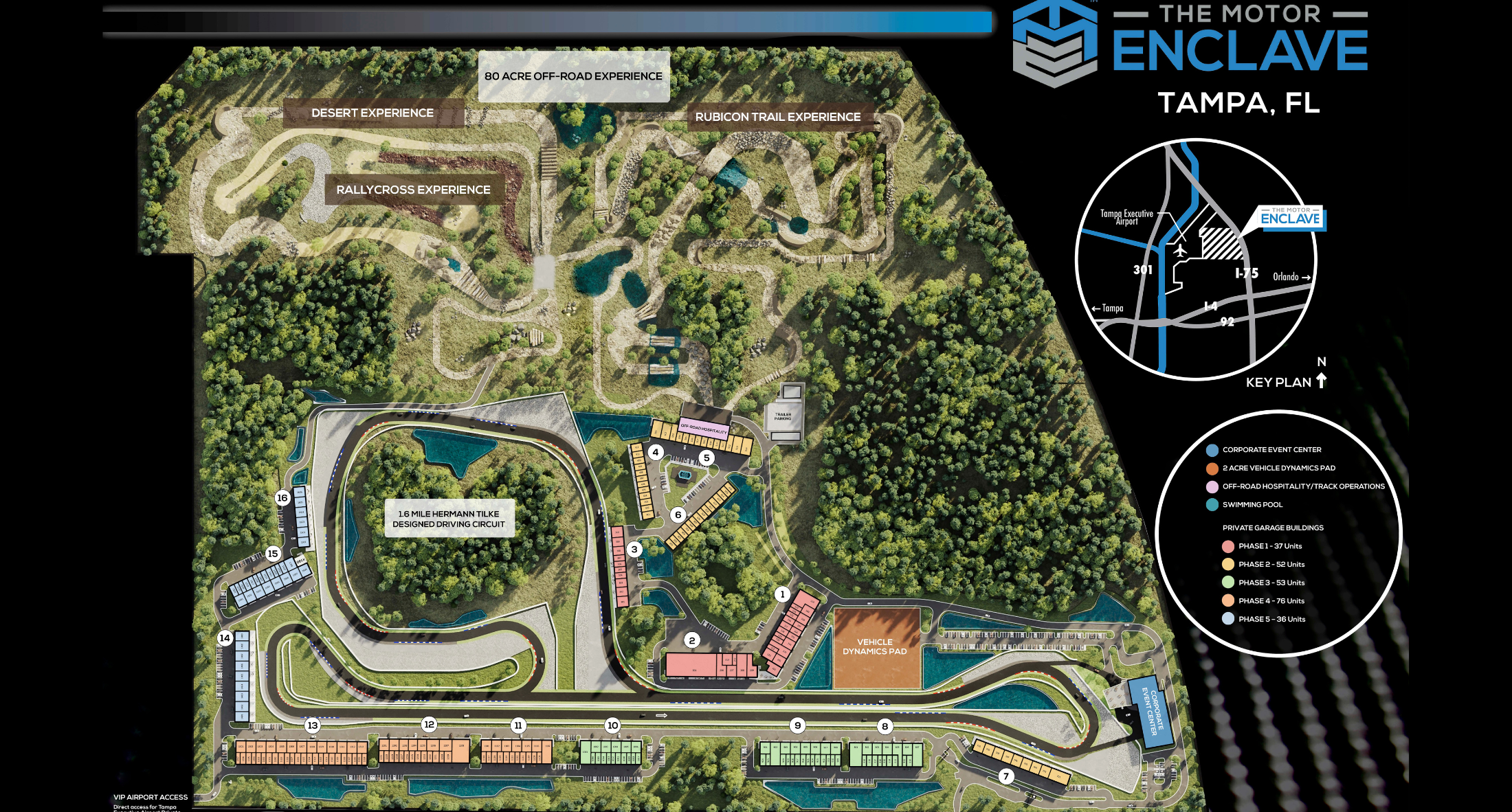

The Motor Enclave Brings High-End Car Condos & Performance Track to Tampa

A mecca for auto enthusiasts is coming to Tampa Bay! The Motor Enclave will feature 300+ private garages, a performance circuit, three off-road courses, a vehicle dynamics pad, and a 37,000-square-foot corporate events center.

The 200-acre property is located between the Tampa Executive Airport and Interstate 75, just north of the I-75/I-4 interchange. Completion of the project is expected in the spring/summer of 2023.

Satisfy Your Need For Speed

The Motor Enclave’s 1.6-mile performance circuit will have 14 bends and a half-mile straightaway, according to famed Formula One track designer Hermann Tilke. Included will be a training course, a RallyCross course, a desert course, and a recreation of the Rubicon Trail, all within the 100-acre off-road area.

Not an expert racecar driver yet? You’ll be able to enroll in paid driving schools where you can learn how to operate high-performance and off-road cars from certified instructors.

Designing a Masterpiece

The Motor Enclave Founder/CEO Brad Oleshansky heads up the $100 million project. The corporate attorney and entrepreneur spent seven years creating the M1 Concourse in Pontiac, Mich. Oleshansky sold M1 in 2019 and is now using the proceeds to launch The Motor Enclave, a chain of similar garage communities across the US.

Additionally, Oleshansky won the coveted Ernst & Young Entrepreneur of the Year Award twice. The first time was in 2012 for Big Communications. And the second award came in 2018 for M1 Concourse.

Fuel Up With Full-Service Amenities

The Motor Enclave’s massive corporate events facility will be able to accommodate gatherings of 10 to 1,000 people. Any and all of the property’s motorized features can be rented out for exclusive use. Public track days will be held throughout the year, and anyone interested in driving on the track can sign up.

Members will have access to a network of paths suitable for hiking and mountain riding. An indoor swimming pool and a members’ lounge at the event center are just two of the many perks available to owners. Also, fun events like festivals, charity galas, driving demonstrations, and Cars & Coffee will make The Motor Enclave the place to be!

You’ll Want to Race to Grab Your Spot!

Reservations are coming in from all over the country, so those interested in purchasing a garage should do so quickly. The ground floors of the 25-foot-tall buildings are between 625 and 2,400 square feet, giving ample space for parking vehicles and accommodating living and working quarters with kitchens, bars, and bathrooms.

It’s up to the buyer to decorate the inside of the “white box” that is the unit. Units run from $300,000 to $1.7 million, and owners pay a $30,000 fee to join and a $6,000 annual fee. See examples of the unlimited garage choices and instructions for inquiring about their availability at themotorenclave.com.

Agent Spotlight: Andrew Ricker

Andrew Ricker is not only a skilled real estate agent, but he’s also a brilliant musician. The multi-talented solo artist sings and plays the guitar, ukelele, and bass guitar. As a premier performer, Andrew’s music career took him to many areas throughout the region, creating lifelong friendships while gaining invaluable insight into the Tampa Bay area.

As a seasoned real estate agent, Andrew provides constant support to his clients in all areas of the real estate process. He takes pride in his commitment to his clients, prioritizes open communication, and values his clients’ needs above all else.

“My favorite aspect of real estate is the relationships that are built and strengthened,” Andrew said. “Not just with my customers but with the lending team, the title company, the inspectors, the builders, the neighbors, and the other agents. I really enjoy talking with people from different walks of life who are able to work together towards a common goal.”

Andrew has lived in Tampa for the past 14 years, leaving the cold winters in New Hampshire for sunny Florida. He received his college degree in Communications from Hillsborough Community College. While Andrew’s career focuses on real estate, you can still see him perform at local bars and restaurants occasionally.

“Go out to Jackson’s Bistro on a Thursday evening, and you’ll surely hear me playing on the patio!” he said.

In his free time, Andrew enjoys live music, golfing, mountain biking at nearby parks, and spending time with his family. He and his wife Christina welcomed their first child in July 2022. He also spends time volunteering.

“I enjoy connecting with the community of Tampa through non-profit events such as Feeding Tampa Bay. I have been involved with and performed live music for many of their events.”

Strike the right chord in real estate, and connect with Andrew Ricker today!

Agent Spotlight: Nancy Collado-Suarez, PA

Relocating from New York City to Florida, Nancy Collado-Suarez knows firsthand the importance of a seamless and positive transition, especially when searching for a home. She has now lived in the New Tampa and Wesley Chapel areas with her family for 17+ years and brings a wealth of knowledge to her real estate customers in the Tampa Bay area.

Nancy’s invaluable skill sets, developed through her education degree from St. John’s University and background in corporate human resources, offer her customers a world-class experience. In her first year with Tomlin St Cyr Real Estate Services, she was honored with the Rookie of the Year award. Her passion for educating buyers and sellers, commitment to professionalism, dedication to service, and steadfast drive to ensure each customer’s experience is smooth and memorable, make her a reliable source for all your real estate needs.

As a first-generation American, Nancy understands the significance of home ownership and investment opportunities. She is fluent in both English and Spanish and will be there to guide her customers every step of the way.

In her leisure, Nancy loves to travel with her family, play with her affectionate golden doodle, volunteer at her church’s children’s ministry, organize fitness accountability groups, and run through the beautiful, palm-tree-filled communities of Tampa Bay.

One of her favorite quotes of all time is…

“Run when you can. Walk if you have to. Crawl if you must. Just never give up.”

This adage has helped Nancy cross the finish line to four marathons. “This quote has been ingrained in my head,” she said. “We should never give up on our goals and dreams. If you can dream it, you can surely achieve it.”

If you would like to connect and learn more about Nancy, please follow her on her social media platforms @sellingtampaflorida or visit SellingTampaFlorida.com.

What You Need to Know About Homeowners Insurance Reform

Florida’s homeowners insurance can be difficult to understand and navigate. But it doesn’t have to be! Pineapple Insurance, under Tomlin St Cyr’s suite of services, is here to help!

If you have any questions or if we can review your existing coverages for your home, flood, auto, or umbrella policies, please contact us at 813-438-7240 or visit us at pineappleinsure.com for important reference information or to request a quote or contact.

Florida’s Homeowners Insurance Market Remains Challenging

In 2022 alone, we had:

- Six homeowners insurance companies were taken into receivership by the State of Florida.

- Two companies have announced that they will withdraw from the Florida homeowners market. They will non-renew their existing policies during CY 2023 and 2024.

- Multiple carriers have restricted new business capacity and initiated non-renewals. They also have taken some rather large rate increases to combat rising costs, principally related to litigation and inflation (labor and materials.)

We experienced multiple storms and ended the year with Hurricane Ian, one of the costliest and personally devasting natural disasters in Florida’s history.

Property Insurance Changes

To combat these challenges, the Florida Legislature held a special session in December. Governor Ron DeSantis signed into law meaningful reform. The purpose of the reforms is to:

- Stabilize the personal homeowners insurance market by allowing carriers to better estimate their future costs

- Reduce frivolous and unnecessary litigation, reducing costs for insurance companies and ultimately the consumer

While we believe these reforms will bring about market stabilization, the next 12-24 months will continue to be challenging as carriers implement these changes and attorneys test the reforms. The Florida Personal Lines property insurance market has faced similar challenges in the past and has always found solutions.

What To Keep Your Eye On

The specific areas of reform are as follows:

- Attorney fees – eliminating one-way attorney fees

- Assignment of Benefits (AOB) – eliminates a policyholder’s ability to execute an AOB for all property insurance policies (but maintains an existing carve-out for seller-to-buyer AOB related to an ongoing insurance claim.)

- Bad Faith – requires a breach of contract before a policyholder can sue a property insurer for settlement-related bad faith; acceptance of an offer of judgment or the payment of an appraisal award, alone, is not sufficient to support a lawsuit.

- Offer of Judgment – makes attorney fees available for the prevailing party in offers of judgment (proposals for settlement) in property insurance cases. It allows joint offers of judgment to be contingent on the acceptance of all joint offerees.

- Florida Optional Reinsurance Assistance Program (FORA program) – creates a program that provides optional hurricane reinsurance that property insurers can purchase at near-market rates. The FORA program is funded with $1 billion in general revenue for the 2023 year and is supplemented by the premium insurers pay for coverage.

- Notice of Claim – reduces the time limit for providing notice of a loss to a property insurer from two years to one year for initial or reopened claims and from three years to 18 months for supplemental claims.

- Claims Investigation and Prompt Payments – changes the prompt pay statute to encourage property insurers to settle claims in a timely manner. This requires the Office of Insurance Regulation (OIR) to collect certain additional data.

- Mandatory Binding Arbitration – codifies that companies, for a premium discount, may issue an optional endorsement with consent from the policyholder that requires participation in binding arbitration to settle a claim.

- Notice to Policyholders – requires that a property insurer place the “Flood Coverage Not Included” statement on the policy declarations page rather than just “with the policy documents.”

- Office of Insurance Regulation (OIR) – enhances OIR’s ability to do market conduct examinations of property insurers after a hurricane. This includes examinations of managing general agents. It allows OIR to discipline insurers for abuse of the appraisal process. This adds information regarding the use of appraisal to the list of information that a property insurer must include in its quarterly reports to OIR. It also allows OIR to review property insurers’ forms, withdraw approval, and suspend an insurer’s ability to invoke appraisal for up to two years. And this requires OIR to add the names of insurers who abuse the appraisal process to its Property Insurer Stability Unit biannual report and post those names to its website; at OIR’s option, allows additional time for agents to place policyholders during insolvencies.

- Citizens Property Insurance Corporation (Citizens) – for renewals and take-out offers (depopulation), establishes that if a renewal or take-out offer from an authorized insurer is within 20 percent of a policyholder’s Citizens premium, including surcharges and assessments being levied, a policyholder is in ineligible to remain in Citizens. For new policies, this establishes that the risk is ineligible for Citizens coverage if the admitted-market policy is within 20 percent of a policyholder’s Citizens premium. This requires Citizens residential lines policyholders to obtain flood insurance as a condition of having coverage from Citizens by 2027. It provides a different glide path for the rates that Citizens charges non-primary residents so that those policies become actuarially sound more quickly. This authorizes Citizens to combine its three policyholder accounts into a single account upon eliminating all outstanding financing obligations to allow Citizens to use its entire surplus to pay claims.

Tomlin St Cyr’s Luxury Collection Is Here!

Tomlin St Cyr’s new Luxury Collection is here to showcase Tampa Bay’s most desired and refined properties! The focus of the Luxury Collection is to deliver a tailored experience to those looking for high-end homes with features such as waterfront locations, exclusive access to country clubs, private, gated neighborhoods, and even acreages.

Tampa Bay Sees Influx of Luxury Home Buyers

The Tampa Bay area has become an increasingly desirable spot for real estate. Buyers from all over the globe are looking for the Florida lifestyle they have always dreamed of. With ample coastline, two major cities, multiple professional sports teams (and MLB spring training destinations), an award-winning international airport, a great local food scene, and land for room to breathe and take in nature, are why so many have chosen to call Tampa Bay home! Buyers from expensive cities in the Northeast, California, and abroad are amazed at how much their money will buy.

Endless Luxury Home Options

Waterfront options range from gulf-front homes with the nation’s top-rated beaches in your backyard to intercoastal waterfront homes with your boat just a few steps from the house. Choose between the vibrant downtown St. Petersburg high-rises or beautiful luxury condos on Bayshore Blvd in Tampa. Find more acreage for quiet estate living in Odessa, Lutz, Tarpon Springs, or Thonotosassa.

Historic residences in South Tampa, like Hyde Park, are within walking distance of high-end shopping, restaurants, entertainment, and culture. Waterfront mansions on Davis Islands offer a secluded feel while still close to all the action. Those looking for a golf course view will fall in love with Avila in northern Tampa, Innisbrook in Palm Harbor, or Golfview in South Tampa.

Luxury Condo Development

Urban areas of downtown St. Pete and Tampa are developing more luxury condo options. Last year the Virage Bayshore opened on Bayshore Blvd, and more on the iconic waterfront boulevard are currently under construction. Bayshore’s Hyde Park House and The Sanctuary boast stunning water and city views and are well underway. Thirty-seven condos top the Edition Luxury Boutique Hotel in downtown Tampa, making them among the most expensive real estate in the city.

St Pete’s Saltaire commands the skyline and comes with dazzling views of the bay. Several luxurious condo buildings grace Beach Dr in St. Pete, giving its residents access to beautiful parks, delicious dining, and the award-winning St. Pete Pier that extends a resident’s backyard right into the bay.

Condos with high-end marinas include Marina Pointe, Aquatica On Bayshore, Plaza One in St. Pete, and Signature Place. Luxury beachfront condos include the Sand Pearl Resort and The Grand on Sand Key in Clearwater Beach.

Suburban Luxury Living

Houses with more space allow homeowners to escape, but that doesn’t mean it will be a long commute. Odessa, Lutz, and Tarpon Springs are less than an hour from downtown Tampa and the globally recognized Tampa International Airport. Stillwater, Steeplechase, and Citrus Green are all in Odessa, with generous lot sizes and custom-built estate homes with release options or the ability to build from scratch.

Lakefront views appear on the northern side of Pinellas County or North Tampa, where Lake Keystone has over 234 acres, and Lake Tarpon has 2,500 acres with beautiful custom estate homes. Thonotosassa, east of Tampa but close to I-4, makes downtown Tampa and Orlando easily accessible. Among the gated neighborhoods is Stonelake Ranch, surrounded by abundant farmland and open space, adding to the privacy and seclusion.

Waterfront Living

Ocean waterfronts stretch from Clearwater to St. Pete, with many different options. Belleair Beach has a charming feel, with fewer vacationers than in other intercoastal areas and an excellent selection of homes on the beach and mainland. St. Pete’s “boat in your backyard” choices include Snell Isles and Venetian Isles, which have beautiful homes on the waterfront with easy access to absolutely everything the bay area has to offer.

On the Tampa side are Davis Islands, Beach Park, and Culbreath Isles, all close to downtown Tampa, in an excellent school system, and a short trip to the airport. Here, boats can also access the Hillsborough River that feeds into the bay.

New Construction

Because of Tampa Bay’s rich history dating back to the early 1900s, there are very few vacant parcels closer to the city centers. However, also consider purchasing a re-sale home if the price is right and the lot is exactly what you are looking for. Builders can build in the cost to take a previously constructed home down to build your dream home.

There are many options to consider when shopping for the right builder. A custom build will be the right option for those who enjoy selecting every detail within the home. There are also many builders with existing floorplans that can make the build process streamlined if you like what they have to offer for selections.

Living on the Green

Golf course options in Tampa Bay include Avila in northern Tampa, with a gorgeous country club and private golf club. Some of Tampa’s most famous residents live in Avila’s custom-built homes that range in style and size. Most homes are ready for move-in, but a few new construction options exist. Golfview, located in South Tampa, borders the private Palma Ceia Golf & Country Club. The Innisbrook area is excellent for custom homes and has a beautiful golf course that hosts a well-known PGA Tour championship each year. Belleair also includes a fantastic country club right along the waterfront.

The possibilities are endless, and luxury home inventory is growing to meet demand. If you haven’t considered Tampa Bay as a place to buy a luxury home, you will now. Contact a Tomlin St Cyr agent today to learn more about our Luxury Collection or to tour one of the lavish properties Tampa Bay has to offer!

Agent Spotlight: Caroline Doyle

When you meet Caroline Doyle, you’ll immediately discover she’s personable and honest, with a relentless passion for helping others with the most outstanding integrity.

“I love seeing the smile on my customers’ faces when they find ‘the one,’” said Caroline. “Their happiness is what drives me to work harder and longer than any other agent. I thrive on building relationships with people and offering them the highest level of customer service to make home buying a pleasurable experience.”

While Caroline grew up primarily in Texas and Minnesota, she moved to Tampa in 2003 to attend the University of Tampa. There she earned a Bachelor of Science in Accounting. Caroline was the social chair of the Beta Alpha Psi honors accounting fraternity and volunteered with the Big Brothers Big Sisters program throughout college. She has now lived in South Tampa for almost 20 years!

Caroline worked in accounting before transitioning to a career in medical sales in Boston, MA. She then returned to Tampa to work as a global associate product manager with a sports medicine company, co-managing a $40M+ business. Now a dedicated Realtor, Caroline and her husband Ryan have two boys, ages 7 and 9, and an adorable cocker spaniel named Molly.

Being involved in the community is extremely important to Caroline. She has volunteered for the Junior League of Tampa and is the social chair of her neighborhood association. Caroline also enjoys giving her time to Metropolitan Ministries and volunteers at her boys’ school and family church. Additionally, Caroline is also an avid tennis player, playing on a USTA team. Her other hobbies include traveling, gardening, reading, and of course, enjoying family and friends.

Caroline is also passionate about helping people buy or sell a home. “It is a privilege, not a job, to get to be the one that makes someone’s dream of their perfect home a reality,” Caroline said. “I love knowing I helped someone secure that one special place where they can truly be themselves, a place that brings them joy and pride. It is also the one constant place where they will build most of their life memories with their family and friends. The kinds of memories that they will look back on and smile or laugh about. I know that’s what my home is for me, and it is a blessing to be the one that helps others obtain that special place.”

Agent Spotlight: Lynn Love

Although Lynn Love finds commercial real estate one of his most challenging careers, he has always lived courageously because he never turns down a new adventure.

Born in Tampa, Lynn Love competed in horseback barrel racing and raised a baby bull for 12 years. Lynn was a great student and also excelled in dance. He attended college on a ballet scholarship, where he met his wife, Kristen. His resume includes the production of a 90-minute feature film. Additionally, Lynn has sailed over 700 miles offshore in the North Atlantic, produced live access public television, performed stand-up comedy, and rode a bicycle across Iowa. Lynn has also generally been self-employed his entire life, but now he leads a life in real estate alongside his dog, Chester.

A real estate agent with Tomlin Commercial Real Estate Services since 2019, Lynn knows what it takes to win and close deals with all his life experience. He finds that very few commercial properties are the same, and all projects differ. With his diverse business background, Lynn can relate to many customers’ situations and needs. This makes him a great adviser. Having been in tight spots and facing challenges that property and business ownership creates, it’s easy for Lynn to give reliable information and insight, which is the most incredible tool in selling commercial real estate.

Lynn believes that giving back to the community is always a good thing. Most of his contributions are not through formal channels or charities. While he occasionally participates in those methods, he prefers giving back unexpectedly in a more one-on-one personal way. For example, he had a chance encounter in a checkout line, allowing him to buy a single mother with three kids all of their groceries. He’ll also pick up a full tank of gas for someone who appears to be struggling at the pump or hand cash directly to someone who looks like they may need an unexpected boost. Giving is giving, and Lynn likes to help folks in a meaningful way when they least expect it.

Although Lynn’s favorite quote is, “If you know too much about something, you will never do it,” he continues to learn more about commercial real estate because it’s become his most rewarding chapter yet.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link